Switzerland Used Car Market Size & Forecast 2025–2033 – vocal.media

The

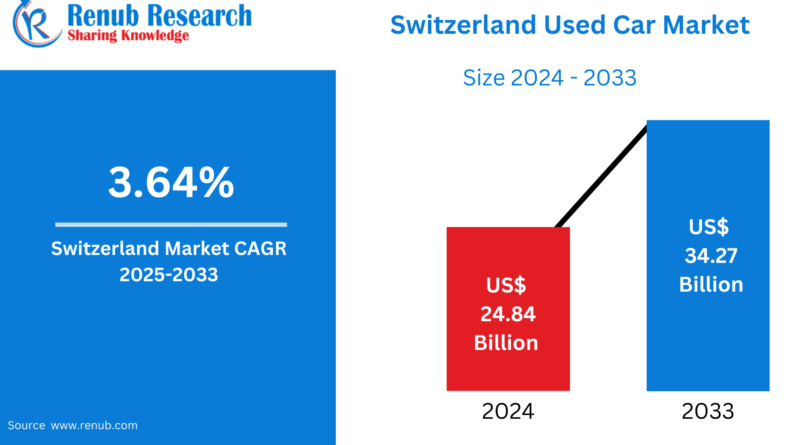

Switzerland Used Car Market is entering a new growth era, driven by affordability, sustainability-focused mobility preferences, and an expanding digital ecosystem. According to Renub Research, the market is set to expand from US$ 24.84 billion in 2024 to US$ 34.27 billion by 2033, reflecting a steady CAGR of 3.64% during 2025–2033. With rising disposable incomes, technological advancements, and the increasing availability of certified pre-owned vehicles, the industry is poised to become one of Europe’s most dynamic second-hand automotive markets.

In a country known for its high living standards, premium car brands, and strong focus on environmental sustainability, Switzerland’s used car sector stands out as an essential pillar of the mobility economy. From Zurich’s luxury automotive ecosystem to Eastern Switzerland’s demand for practical cars, the market serves diverse consumer needs—whether price-driven, lifestyle-driven, or technology-driven.

Understanding Switzerland’s Used Car Market

A used car is any vehicle previously owned by one or more individuals. In Switzerland—where taxes, premium imports, and advanced technology increase the cost of new vehicles—used cars present a financially appealing alternative.

Why used cars are increasingly preferred:

They offer significant cost savings over new cars.

Inflation and supply chain disruptions have raised new car prices, making used vehicles more attractive.

Certified pre-owned (CPO) programs provide warranties and reliability.

They extend vehicle lifecycles, promoting sustainability and waste reduction.

For many first-time buyers, families, and daily commuters, used cars deliver flexibility and value without compromising Swiss standards of quality.

Key Growth Drivers in the Switzerland Used Car Market

1. Rising Demand for Affordable Mobility

Switzerland is home to some of the world’s most expensive new vehicles due to taxes, safety standards, and strong market preference for premium brands. Consequently, used cars offer a rare balance of affordability and quality, making them especially attractive to:

Young professionals

First-time car buyers

Budget-conscious households

Switzerland’s well-maintained roads and high regulatory standards ensure that used cars remain in excellent condition, even after years of use. This boosts resale confidence and strengthens the market pipeline for high-quality second-hand vehicles.

Additionally, an important global mobility conversation took center stage in October 2023, when Futura-Mobility’s delegation visited Switzerland to meet innovation leaders and discuss emerging technologies. This highlighted the country’s expanding focus on sustainable, efficient mobility—including modern car ownership and used vehicle ecosystems.

2. Short Vehicle Replacement Cycles

Swiss consumers often upgrade their vehicles faster than buyers in other countries. Motivated by high disposable incomes and a preference for the latest safety and environmental technologies, the average Swiss car owner changes vehicles every few years.

This leads to a steady supply of:

Low-mileage vehicles

Well-maintained cars

Recently launched models with updated features

Certified dealerships benefit the most, offering reliable stock for a competitive second-hand market.

These shorter replacement cycles allow the used car market to continually refresh itself with high-quality vehicles—something that is particularly appealing for buyers seeking premium brands at reduced prices.

3. Growing Digital Ecosystem and Online Platforms

Digitalization is transforming the used car trade across Switzerland. Buyers today expect transparency, vehicle history records, virtual tours, and price benchmarking—all accessible online.

Major developments include:

AutoScout24.ch launching AutoScout24 Direct in 2024, enabling private sellers to connect directly with national dealers via its partnership with CarAuktion.

Growth in AI-based valuation models and virtual inspections.

Expansion of financing options directly on digital platforms.

With Switzerland’s young population preferring seamless online experiences, the shift toward structured, trust-based online marketplaces is accelerating. The digital boom is reshaping the market, reducing fraud, and making transactions easier and faster.

Key Challenges in the Switzerland Used Car Market

1. Rising Demand for Electric & Hybrid Vehicles (EVs)

Switzerland is adopting sustainable mobility at a fast pace. However, the used EV market is still underdeveloped, leading to challenges such as:

Low supply of second-hand EVs

Uncertainty around the resale value of combustion vehicles

Government incentives pushing buyers toward new EVs

As the country pushes toward green mobility, gasoline and diesel vehicles may gradually lose resale momentum—forcing traditional used car dealers to re-evaluate inventory strategies.

2. Pricing Transparency and Competitive Pressure

Online platforms have made pricing highly transparent—but also highly competitive. Buyers compare dozens of listings in minutes, putting pressure on dealers to:

Lower markups

Introduce aggressive financing

Strengthen after-sales service

Small unorganized sellers are particularly affected, as professional players increasingly dominate with better warranties, digital services, and verified listings.

Foreign exchange fluctuations and import taxes further complicate pricing strategies, making differentiation crucial for long-term market survival.

Segment Analysis: Switzerland Used Car Market

Used Sedans

Sedans remain a dependable and popular segment. Their appeal stems from:

High fuel efficiency

Excellent comfort

Lower depreciation than larger vehicles

Swiss buyers appreciate pre-owned premium sedans from Mercedes-Benz, Audi, and BMW—offering luxury at significantly lower prices. Sedans continue to hold steady market demand, especially in urban and budget-sensitive customer groups.

Used SUVs

SUVs have experienced a surge in popularity, mirroring global trends. Their advantages include:

Spacious interiors

Advanced safety technology

Capability across Switzerland’s mountains and varied terrains

Premium SUVs from Land Rover, Volvo, and Audi are sought after in the used car market due to their high initial depreciation—making them more affordable once pre-owned.

Families and adventure-oriented drivers are particularly strong contributors to SUV demand.

Organized Used Car Market

Dealerships, certified pre-owned outlets, and professional reseller networks are rapidly expanding in Switzerland. Their benefits include:

Warranty-backed vehicles

Detailed inspection reports

Buy-back and trade-in services

Financing and insurance solutions

Although they may be more expensive than private listings, organized sellers offer peace of mind—something especially important for young or first-time buyers.

Fuel Type: Gasoline Still Leads

Despite sustainability trends, gasoline vehicles continue to dominate the used car market because of:

Affordable maintenance

Strong urban performance

Wide availability

However, the gradual rise of hybrid and electric vehicles will slowly reshape fuel-type dynamics over the next decade.

Online Used Car Market

Digitally driven buyers and sellers are reshaping Switzerland’s used car evolution. Platforms now offer:

Verified vehicle histories

Price comparisons

Doorstep services

Virtual tours and AI-based inspections

While physical inspections remain important, online-first approaches are accelerating convenience and boosting structured dealer participation.

Regional Insights

Zurich

As the financial engine of Switzerland, Zurich leads the used car market in:

High purchasing power

Luxury used car availability

Strong dealership presence

Emerging EV-focused second-hand options

The city’s corporate culture and sustainability commitments further strengthen market demand.

Eastern Switzerland

Regions like St. Gallen and Graubünden favor:

Practical vehicles

All-weather SUVs

Compact city cars

Cross-border trade with Germany and Austria introduces price efficiencies and increases the availability of imported used cars.

Ticino

Close to Italy, Ticino’s used car market is heavily influenced by:

Italian brands (Fiat, Alfa Romeo)

Cross-border vehicle imports

Cost-sensitive urban mobility habits

Its multicultural consumer base makes it a uniquely diverse regional market.

Market Segmentations

By Vehicle Type

Hatchbacks

Sedans

Sports Utility Vehicles

Others

By Vendor Type

Organized

Unorganized

By Fuel Type

Gasoline

Diesel

Others

By Sales Channel

Online

Offline

By Region

Zurich

Espace Mittelland

Lake Geneva

Northwestern Switzerland

Eastern Switzerland

Central Switzerland

Ticino

Key Companies Covered (with 5 Viewpoints Each)

Emil Frey AG

AMAG Automobil and Motoren AG

Mobility Cooperative

Carvolution AG

AutoScout24 AG

Auto Kunz AG

Comparis AG

Gowago AG

CAR FOR YOU AG

These companies are evaluated across:

Overview

Key Person

Recent Developments

SWOT Analysis

Revenue Analysis

Final Thoughts

The Switzerland Used Car Market is entering a significant transformation phase. With digital platforms expanding, sustainability trends influencing buyer choices, and affordability remaining a central factor, the market is set for sustained long-term growth. While challenges such as EV adoption and pricing competition persist, the industry’s rapid shift toward organized, transparent, and tech-enabled systems ensures a promising future.

By 2033, the sector will not only be larger—but smarter, greener, and more customer-driven than ever before.

Market Research

How does it work?

There are no comments for this story

Be the first to respond and start the conversation.

More stories from

Aman Ahirwar and writers in Serve and other communities.

France’s car rental industry is entering a transformative decade. Supported by soaring tourism, digital mobility platforms, and rising demand for flexible transportation solutions, the market is on track for significant expansion. According to Renub Research, the France Car Rental Market is projected to reach US$ 10.72 billion by 2033, up from US$ 6.34 billion in 2024, growing at a CAGR of 6.01% during 2025–2033.

By

a day ago in

Serve

This month sees Veterans Day (November 11) in the United States. It celebrates, honors, and thanks those who served in the United States Armed Forces. November 11 is also Remembrance Day. It honours the end of World War I and remembers all service members who died in conflict.

By Calvin London23 days ago in Serve

The United States Taxi Market is expected to reach US$ 159.13 billion by 2033, rising from US$ 82.65 billion in 2024, according to Renub Research. This impressive trajectory reflects a CAGR of 7.55% from 2025 to 2033, fueled by rapid urbanization, expanding tourism flows, digital adoption, and the rise of autonomous mobility.

By Aaina Oberoi6 days ago in Serve

Culture is a river flowing to an ocean of collective belief. Lest we are lost at sea, we must wrest our way to the banks and build a new life in the wilderness.

By C. Rommial Butlerabout 20 hours ago in Fiction

© 2025

Creatd, Inc. All Rights Reserved.