UK New Car Market Starts 2026 Strong, but EV Targets Remain Elusive – Electric Cars Report

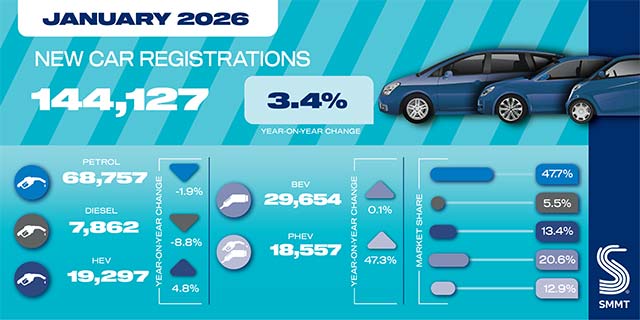

The UK new car market began the year on a positive note, growing by 3.4% in January to reach 144,127 registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). This marks the strongest start to a year since pre-pandemic 2020.

Growth was recorded across all buyer segments. Private retail registrations increased by 4.5%, fleet registrations rose by 1.6%, and the low-volume business segment saw a sharp 46.5% increase. Fleet purchases continued to dominate the market, accounting for 61.2% of all new car registrations.

Battery electric vehicle (BEV) uptake, however, showed minimal growth, rising just 0.1% to 29,654 units. This translated into a 20.6% market share—the lowest level since April 2025. The slowdown follows an unusually strong January last year, when buyers advanced purchases to avoid new BEV tax rates introduced in April. In addition, manufacturers’ end-of-year efforts in 2025 to meet regulatory targets likely pulled demand forward, weighing on January’s figures.

Plug-in hybrid vehicles (PHEVs) once again delivered the strongest growth among electrified powertrains, rising 47.3% year on year and accounting for 12.9% of total registrations. Hybrid electric vehicles also posted a solid increase of 4.8%, capturing 13.4% of the market.

January is traditionally a lower-volume month and not always a reliable indicator of full-year performance. Reflecting this, the latest market outlook forecasts new car registrations to grow by 1.4% over 2026, reaching 2.048 million units—an improvement on projections published in October.

Expectations for BEV growth in 2026 have strengthened, supported by wider model availability, improved driving range, and the reintroduction of government support through the Electric Car Grant. BEVs are now forecast to account for 28.5% of new car registrations. While this would represent meaningful progress compared to 2025, it would still fall well short of the mandated 33% target.

This projected shortfall persists despite billions of pounds invested by manufacturers in new models, incentives, and pricing support, alongside continued improvements in charging infrastructure. These trends suggest that the assumptions underpinning the current mandate no longer reflect market realities. With additional demand pressures expected following the proposed introduction of electric vehicle excise duty (eVED) from 2028, an urgent and comprehensive review of the transition is increasingly necessary.

Commenting on the figures, SMMT Chief Executive Mike Hawes said the UK new car market is rebuilding momentum after a difficult start to the decade and is decarbonising faster than ever. However, he warned that while electric vehicle demand is expected to recover later in the year, progress remains behind mandated targets. With the planned end of new petrol and diesel car sales less than four years away, Hawes stressed the need for a realistic reassessment of the transition to ensure policy ambition aligns with market conditions.

Blagojce Krivevski is physicist and green technology lover. Keep in touch with Blagojce through his email, web site, Twitter, Linkedin, Facebook and Google+.

Email: contact@electriccarsreport.com